I’ve always been a climate optimist. I’ve believed that the combination of new technologies and market demand will ultimately help us stop climate change.

Recently, though, I’ve had some doubts. Yes, we’re all embracing the idea that we should do something about climate. But are we doing enough and doing it quickly enough?

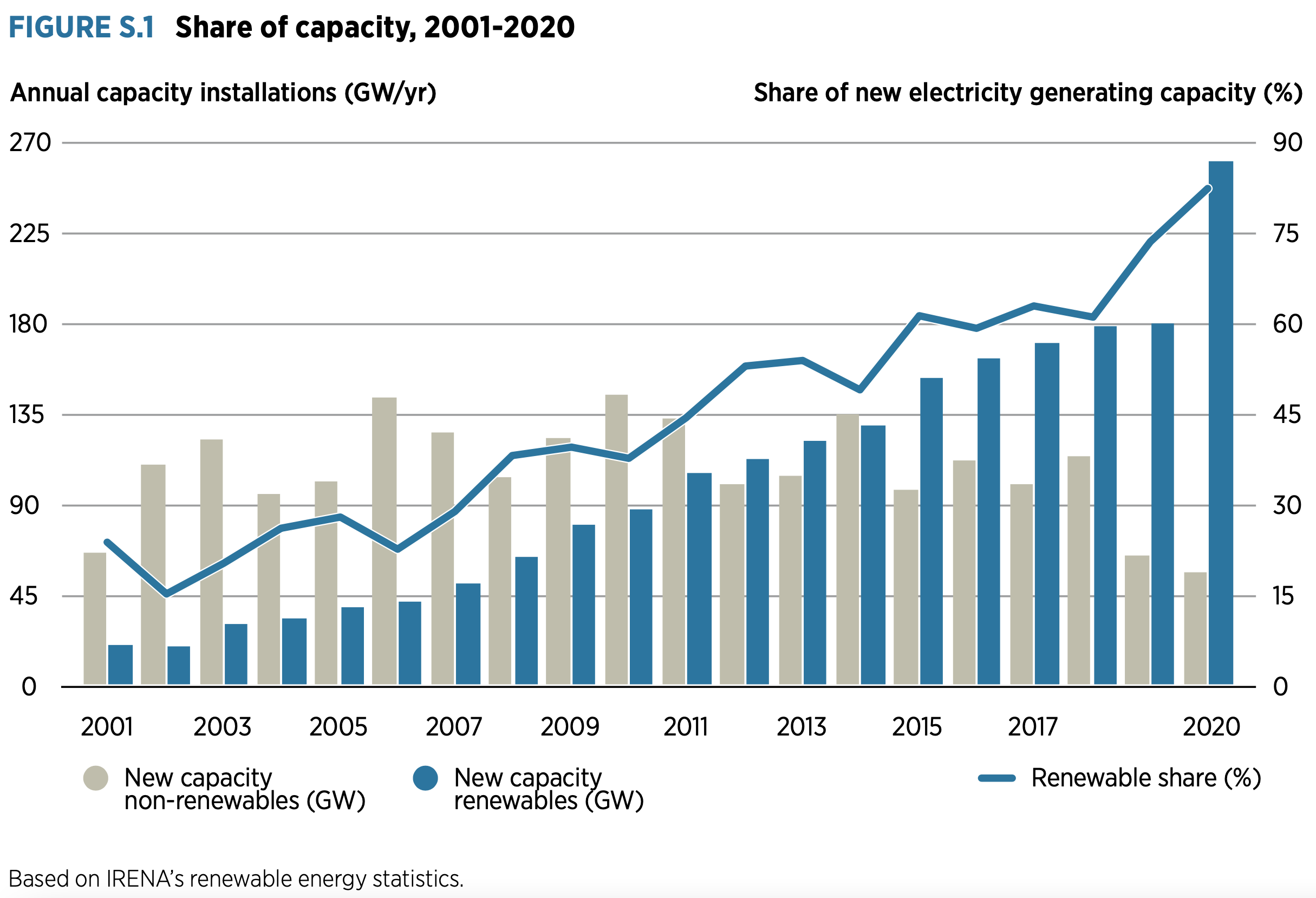

For example, you might think that we’re winning the fight against climate change because renewable energy is taking off:

Source: IRENA World Energy Transition Outlook

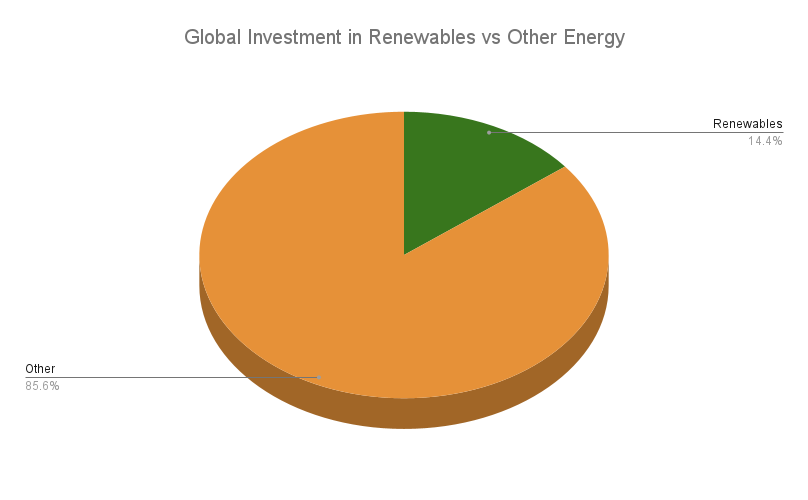

But did you know that the global investment in energy last year was $1.9 trillion, of which only about one-sixth ($320 billion) went to renewable energy?

Source: IRENA Global Landscape of Renewable Energy Finance, IEA World Energy Investment 2021

So even when all the stars are aligned–The technology is mature, there is manufacturing capacity, and there is a cost advantage–there’s still a lot of “business as usual.” What will happen to the other high emissions sectors where that’s not the case, like steel, cement, transportation, and agriculture? Even if the billions pledged by Bill Gates make the technology available, when will the trillions for deploying those technologies show up?

I’m not here to point blame at anyone. Rather, I’d like all of us to go back and ask “What more could I do?“

Having been a fund manager, I realized that I couldn’t just say “So long and thanks for all the fish,” and move on when I saw that sustainable investing is viewed as a preference rather than a necessity.

I also believe, fundamentally, investors could play a central role in stopping climate change. They are the group acting on the longest time horizons. Whereas elections happen every few years, pension funds, life insurers, and endowments invest for ten, twenty, thirty years, or even longer. They also must do something about climate change, because it is that will hurt their investments.

So where could I have the maximum impact?

It’s true that ESG investing has already been on the rise. It’s also true that major investors with trillions of assets have pledged to reduce emissions in their investments through initiatives like Net Zero Asset Managers and Climate Action 100+.

When you get to the ground level, though, you’ll find that translating those pledges into action has been slow and difficult. Like every other industry, investment management has a lot of existing institutions that are slow to change from “busines as usual.” See, for example, “The Secret Diary of a Sustainable Investor,” where the former head of ESG at BlackRock describes his experiences.

The problems he encountered all sound true. Yet I believe there is a way forward. The key is to streamline climate investing and turn into action: trades that could be done, benchmark indices that could be written into guidelines, and funds that investors could invest in.

This is not as difficult as it sounds. It’s true that ESG is hard to quantify, with a lot of different and conflicting metrics. As a result, some complain that it’s not clear how invest with ESG. But as portfolio managers and traders, we’re used to this. Our job is to sort out conflicting signals and judge the unknown. In fact, we never know what the “true value” of any asset is, and nor do we ever need to. We just need to be able to value assets relative to each other correctly, and then trade on these relative value judgements.

So drawing upon my experience, I’ve put together an open source project for climate investing. You can access both the code and the data at github.com/opentaps/open-climate-investing. Based on recent academic research, this project extends the popular Fama and French and Carhart factor models with an additional “Brown Minus Green,” or BMG, carbon risk factor. This factor allows us to judge the climate risk of any investment based on its market prices relative to a set of investments with known carbon risks. So instead of pouring through ESG reports for every company, you can make investment decisions based on how the market is judging climate risk.

This small change in perspective yields a wealth of new insights. You can use it to identify mispricings in the market, judge the effectiveness of ESG funds, even decipher the market’s views on the carbon transition. It also helps make climate investment decisions on companies for which no ESG disclosures are available.

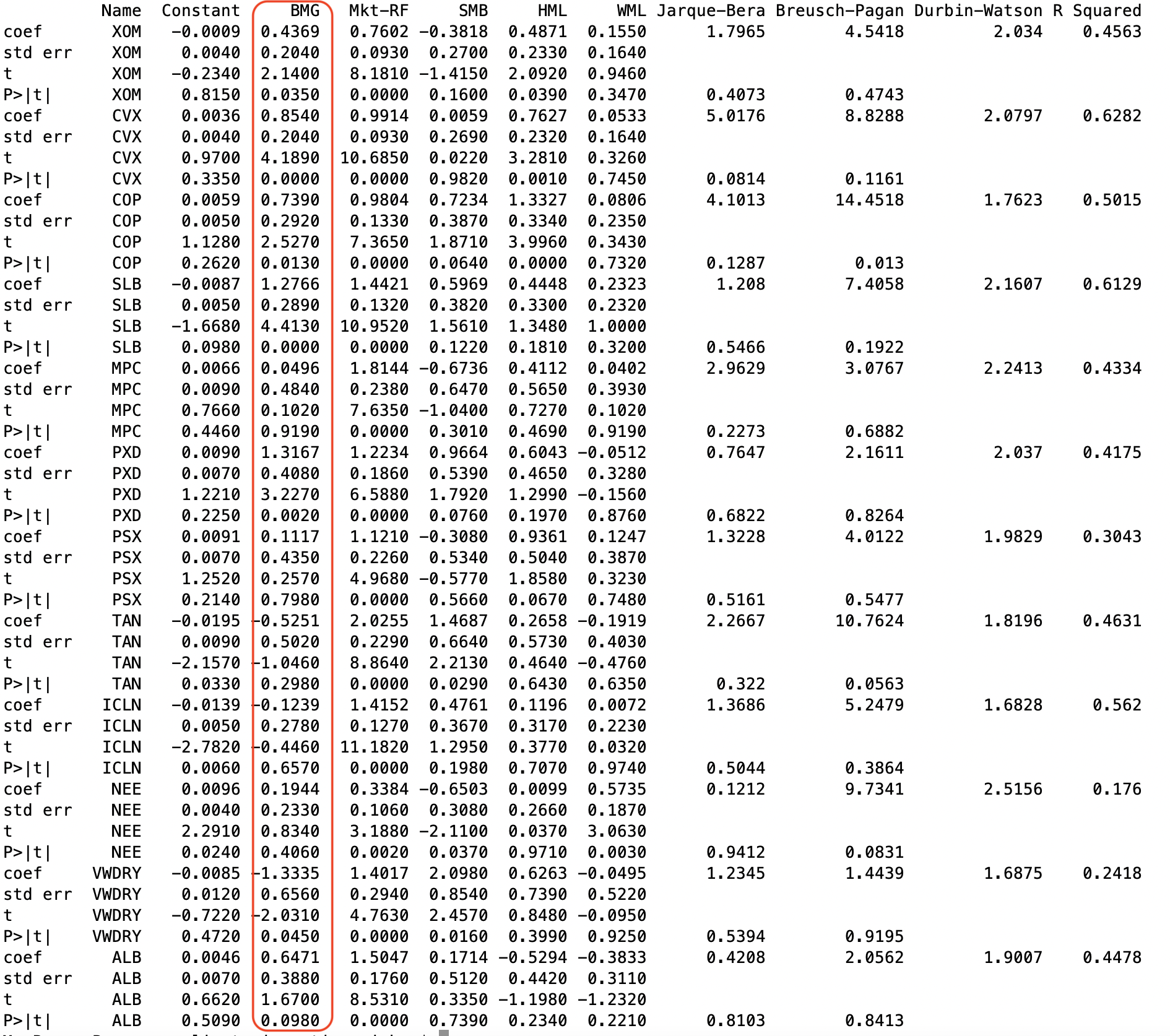

For example, take a look at this analysis I performed on 7 Best Oil Stocks to Buy and 7 Renewable Energy Stocks and ETFs to Consider. Pay attention the highlighted column, which shows what the carbon risk factor is for these stocks and ETF’s, and the t-statistic below which shows how statistically significant those risk factors are:

In brief, what this shows is that the market believes that Chevron (CVX) and ConocoPhillips (COP) have higher climate risk exposures than ExxonMobil (XOM), with BMG carbon risk factor of 0.85 and 0.74 vresus 0.44. Furthermore, the oil exploration companies Shlumberger (SLB) and Pioneer Resources (PXD) have higher risks than any of the integrated oil companies, with BMG carbon risk factors of 1.28 and 1.32. All these companies have statistically significant t-statistics.

Conversely, the market believes that only Vesta Wind (VWDRY) has a significant negative carbon risk factor (-1.33), so that it can be expected to go up (down) when the oil companies go down (up.) The other renewable companies and ETF’s do not actually have either negative carbon risk factors, or their carbon risk factors are not statistically significant.

Is the market right? Are the ETF’s portfolios not “green enough”? Or is the market mispricing their securities and not giving them enough credit? This is a bigger topic than a blog post. If you’re interested, please read the book that I’m writing as part of the open source project.

This model is just the starting point. To make climate investing a reality, change must happen not just with the portfolio managers of the funds, but with the guidelines or benchmarks of the funds they manage. Every fund, from mutual funds sold to individual investors to the biggest pensions in the world, has a specific index to compare its investment results against. Woe be to the manager who underperforms it. So while portfolio managers think they are in charge (easy to do when salespeople tell you how smart you are every day), they could not invest differently until their guidelines change.

And what will it take to change those benchmarks so they address climate change? First, having alternative benchmarks which incorporate climate exposures while meeting the investment strategies of the plan sponsors. It’s not good enough to have ESG indices or Paris Agreement aligned indices when the plan sponsors want to invest in biotech, growth, or floating rate bonds. There must climate aligned biotech indices, climate aligned growth indices, and climate aligned floating rate bond indices for them to benchmark those investments against.

Then the plan sponsors must act. They need to change their benchmarks to those climate aligned indices. What will that take? More education and awareness? A change in how we view the legal concept of fiduciary responsibility? Grass roots mobilization of the plan beneficiaries?

The truth is I don’t know. I was just a humble portfolio manager who managed against the benchmarks I was given.

As you can see, this challenge is obviously much bigger than any one person, one company, or even a whole industry. So that’s why I’m coming back to open source: The only way we can do this is by working together and collaborating.

You can help: If you’re an investor–whether you’re a fund manager, plan consultant, plan sponsor, individual investor of a mutual fund, or even beneficiary of a pension plan–Use our open source project to evaluate the climate exposure of your funds. It would not only help the climate but help your investments! Ask for more climate aligned benchmarks for your fund and more climate aligned funds in your 401K plan. (Make sure they really have lower climate exposure–again, use our our project.)

If you’re an open source developer, join our project! It’ll be a way to do something about climate while learning about a very interesting field. I’ll be happy to help you along the way.

And if you have financial modeling experience, please contact us–we have openings for quants!